However November saw stronger growth in retail sales than forecasted, with heavy and extended Black Friday discounting said to be key drivers.

Some UK retailers reported an increase of 8% footfall in stores over the Black Friday weekend when compared to the previous week, and overall Black Friday sales grew 4.1% on last year to £1.04 bn.

Meanwhile, performance in December was less strong with growth below the average of 2023 and sales volumes falling by 3.2%, the sharpest drop since the UK was in lockdown. Extended discounts and promotions across all sectors in November were a contributing factor to reduced spend in December as consumers snapped up the biggest discounts across the Black Friday and Cyber Monday weekend and beyond.

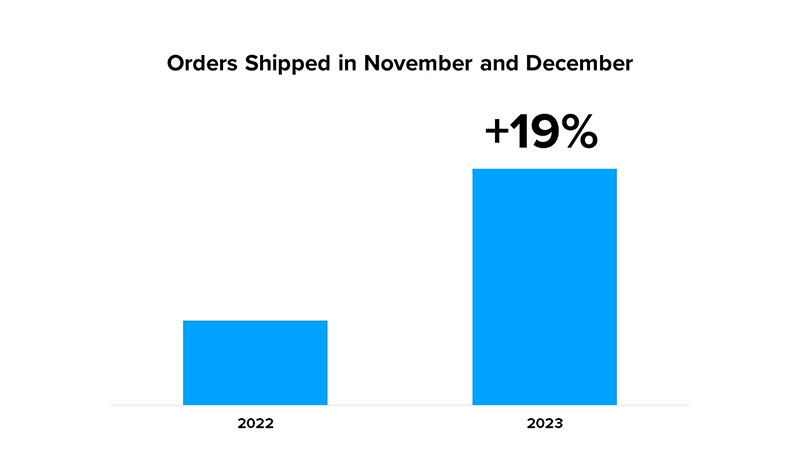

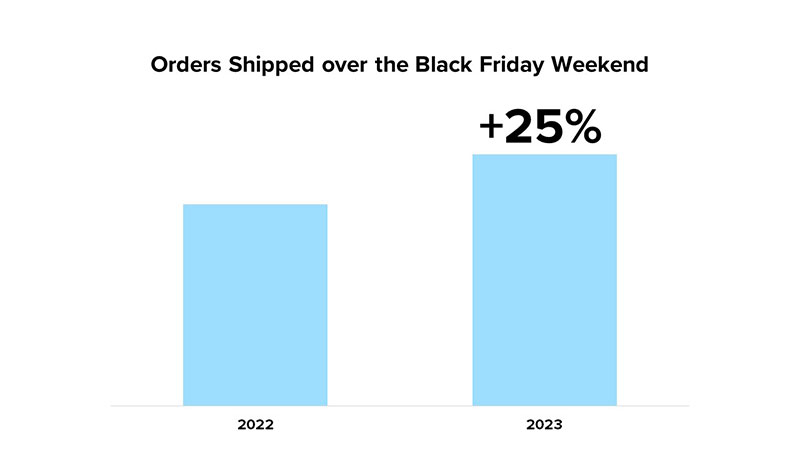

Peak 2023 in Numbers at ILG

Reflecting on ILG’s performance over the 2023 peak period, we saw that many of our customers went above and beyond the average growth seen across the UK. Taken together, the months of November and December 2023 were our most successful peak trading period yet, with an uplift of 19% in order volumes year-on-year and a 25% increase in orders over the Black Friday/Cyber Monday weekend compared to 2022.

Visit our Peak Hub for tips and advice on how to prepare your business for your next peak

How did the Beauty Industry Perform this Peak?

With many years as a beauty fulfilment specialist, we are pleased to see continued growth in the beauty industry with Barclays reporting Pharmacy, Health and Beauty spending up 3.8% YOY in December 2023. Even as 59% of consumers say they actively seek deals and discounts more than previously due to the increased cost of living, the beauty industry still saw some growth.

Paul Martin, UK Head of Retail at KPMG comments that ‘Christmas shoppers ditched clothing, jewellery and technology gifts opting for beauty, health and personal care products, which, along with food and drink drove festive sales this year’. The beauty industry appears to be bucking the trend as people spend less on clothing, eating out, electronics and sports goods.

Is Beauty Really Recession-Proof?

So why was beauty shopping less prone to squeezes in consumer spending power over 2023 peak? Beauty clearly continues to be a popular choice for gifting. As Helen Dickinson OBE, CEO of British Retail Consortium states, beauty gifts ‘were the standout performer’ when it came to Christmas sales. With a large proportion of ILG’s customers in the beauty and wellbeing industries, we can see this trend through our customers’ strong performance.

As was evident during the pandemic, products that make you feel and look good continue to resonate with consumers, even when times are hard and budgets limited. For example, in the weeks after lockdown, fragrance company Diptyque, saw candle sales increase 536% and Selfridges reported beauty as its strongest category. Coined the ‘lipstick effect’, the theory suggests that despite tough economic conditions, consumers still choose to purchase luxury products but opt for lower cost items such as lipsticks.

Is beauty recession-proof? Evidence shows the beauty industry holds up comparatively well when the economy downturns. Could it be the attitude change that looking and feeling good is now a necessity rather than a luxury to many? Rather than spending hundreds to feel good at a spa for example, do consumers get the same pick-me-up feeling from new beauty products? Are beauty consumers some of the most loyal?

While all these are contributory factors, it’s unclear exactly why beauty sales continue to hold up under today’s economic pressure. What we do know is that when it comes to peak season 2023, many of ILG’s customers hit the ground running, with healthier-than-ever order volumes. Look out for a future blog where we look behind the numbers to see whether Peak 2023 really lived up to expectations.